Strategizing The Store Within A Store Concept

A Case Study On Retail Collaborations

By Alexis Cortez

Published Mar 4, 2022

By Alexis Cortez

Published Mar 4, 2022

How does someone build a new and engaging experience in the modern age of retail commercial real estate?

One answer is the “Store-Within-A-Store'' partnerships that seem to keep popping up across every brand category. You've probably seen something like this before; Barnes and Noble and Starbucks, which formed B&N Café in the early 2000s. Or JCPenney, who partnered with Sephora in the 2010s and built small, dedicated stores right in the middle of their department stores. Over the past year, we've seen other major brands starting to play this game, such as Target, Kroger, and Macy's. While some are still in development, like Macy's and Toys R Us, it's still interesting to look at some data.

Target has announced a series of major brand partnerships over the last year. They have a long history of successful partnerships over the years, like their partnership with Starbucks and Pizza Hut for the front end of their stores. These partnerships aren't a surprise and have become more the norm.

Disney announced they were closing stores in early 2021, but would be pursuing other retail options, like the one we're seeing with Target. Apple will be keeping their established stores, but are expanding on an established retail strategy by copying their store layouts from their partnership with Best Buy. ULTA, the major competitor to Sephora, is also another perfectly timed partnership since JCPenney and Sephora's partnership contract is set to expire in 2023.

Target's growth remained pretty stable from 2013 to 2017 and took off after that, growing almost 200 stores in one year. Target is categorized as a Discount Department Store in our system, which is one of our most popular merchant categories overall, and a popular anchor tenant for commercial real estate experts. That's where REGIS Online comes in. We wanted to see the potential opportunity for both Target and their partners, as well as how they could improve their retail strategy. Since we're located in Chandler, Arizona, we looked at the Phoenix Metro Area for more information.

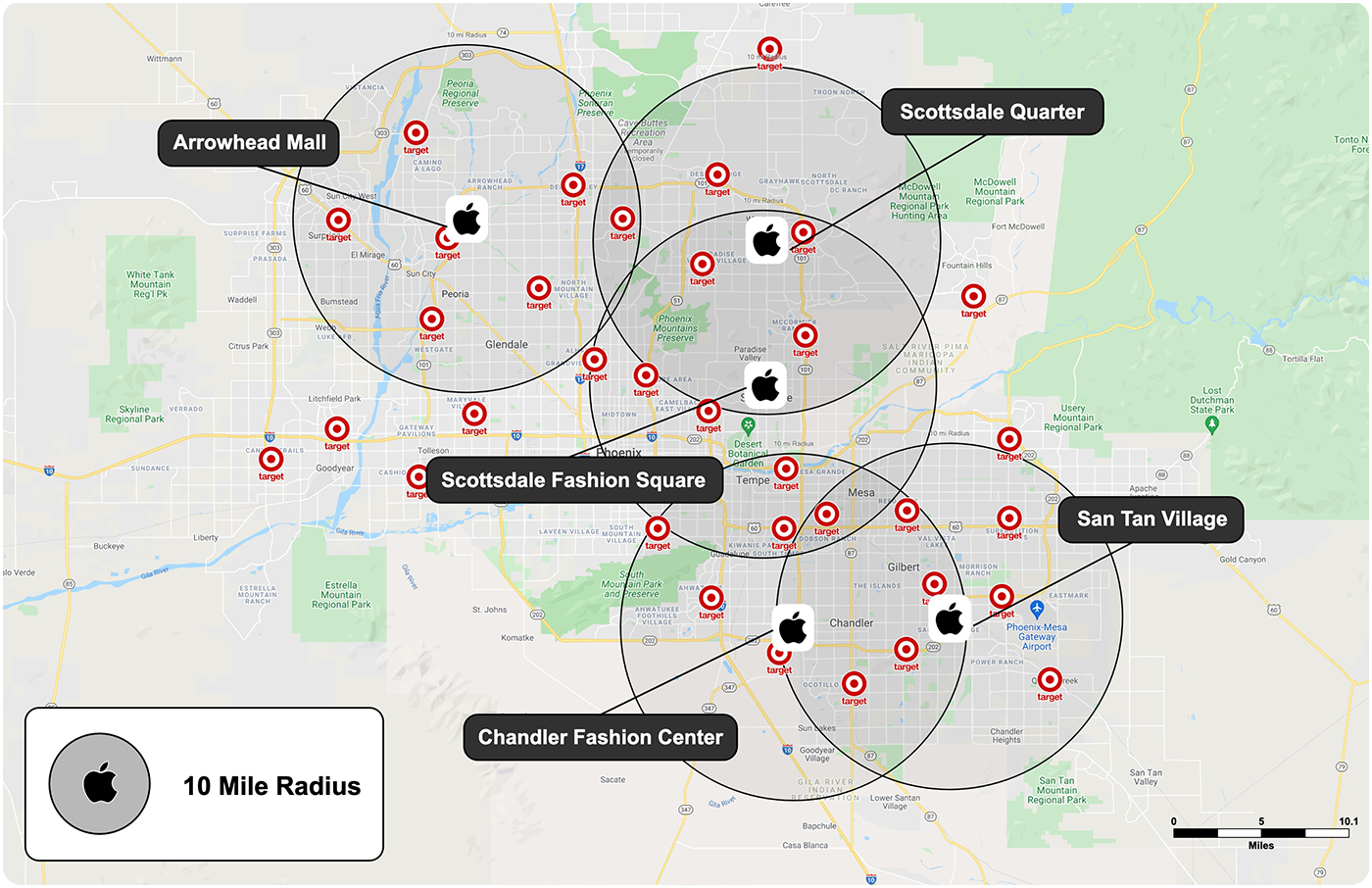

Let's take a look at Apple Stores. Mostly found in Regional and Super Regional Malls across the country, Apple has maintained a fairly stable real estate portfolio of 272 stores since 2017, and 250+ stores since 2013. They have 5 locations in Phoenix, spread out across the valley, which makes this a bit easier. However, there are also 34 Targets in the area, so we have a lot of options to choose from for a mini Apple Store. We chose to keep a distance of 10 miles away from any Apple Store in the area, especially since most of the Apple Stores in the valley are located inside malls. This left 7 stores outside these 10-mile radius rings. These could be a great place to start looking at expanding retail strategies for Apple. Since Target has been expanding its curbside pickup program, it might even be a good time to check drive times and population data for their stores. Check out our final map with all this data below.

REGIS Online is a powerful mapping and demographic software tool built for commercial real estate, but it can also do so much more. We believe REGIS can build communities, enable success, and create long-term solutions for commercial real estate professionals and their careers. •

Last Modified Mar 4, 2022

The tech and bold ideas behind the biggest changes in the industry.

What's next for restaurants in commercial real estate?

A case study on retail collaborations in the new tech era.