The 3 Online Retailers

Building Brick & Mortar Stores

Can online retailers successfully expand into retail commercial real estate?

By Alexis Cortez

Published Aug 26, 2022

By Alexis Cortez

Published Aug 26, 2022

Direct-to-consumer brands have been making headlines for over a decade now. Think of brands like Warby Parker, Bonobos, Rothy's, Blue Apron, Casper, Glossier, and Quip. While there are plenty more direct-to-consumer (or DTC) companies ready to take your credit card information, these are probably some of the most well-known “DTC” brands that are expanding into brick-and-mortar stores. But what does this mean for commercial real estate?

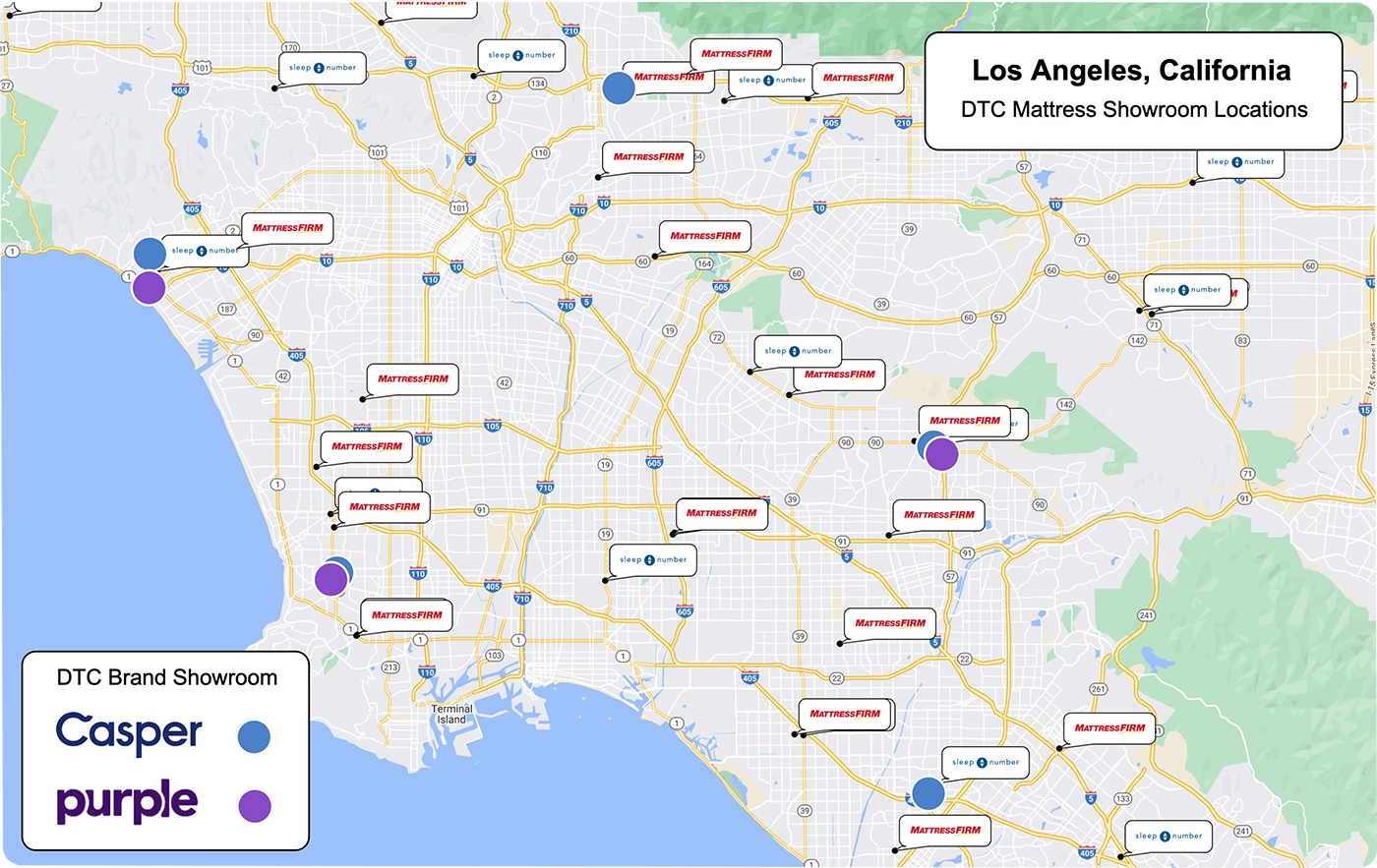

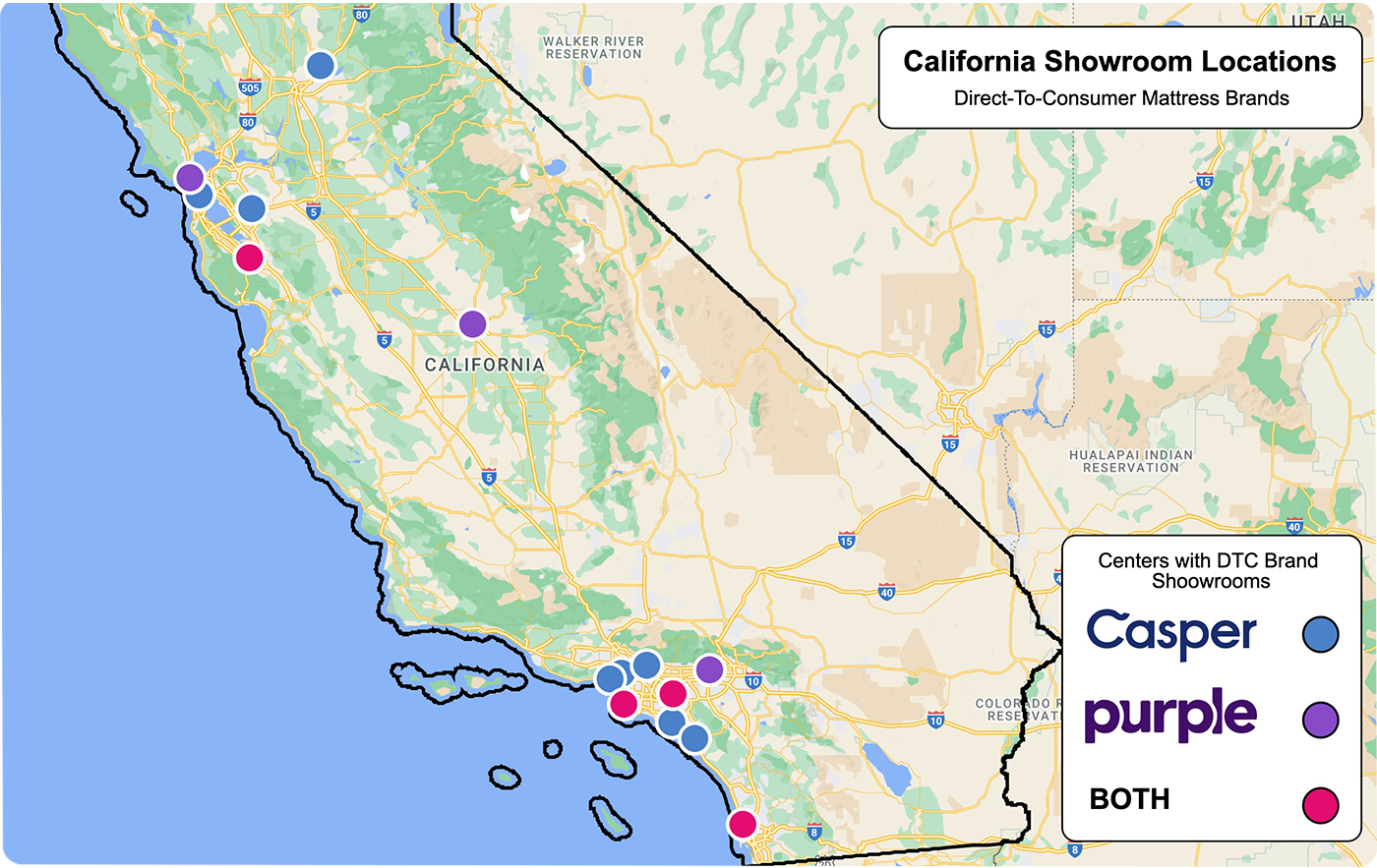

Most of these DTC companies have barely been around for 10 years, but they have already had a huge impact on their competitor's ability to seem relevant. Casper has been able to completely turn the mattress industry upside down and innovate where most thought impossible. Of course, buying online is easier; But, so is shipping and customer service. Maybe that's why we've seen other DTC mattress companies like Purple, Tuft&Needle, and Nectar do so well with this brand strategy. While Mattress Firm and Sleep Number used to be the only options for an in-store experience, Casper and Purple stores have been popping up in malls and shopping centers across the country. Casper opened their first store in 2018 and has expanded to over 65 stores since. Purple has taken a slightly different approach, however. They have their own showrooms in certain markets but mostly use space in other stores like Mattress Firm, Living Spaces, and Macy's.

Probably the most well known DTC company is Warby Parker. They have fundamentally changed the way people shop for glasses, contacts, and other eyewear. When comparing prices, Warby Parker has every other company beat, along with convenience, ease, and experience. Warby Parker is most well known for their website and Home try on shipping. However, Warby Parker has been pursuing brick-and-mortar stores since 2013, and recently reached 150 locations nationwide. They're expanding even more, with plans to have 200 locations by the end of 2022. Other eyewear companies like Visionworks, LensCrafters, and Pearle Vision are all having to adjust in big ways. Since Warby Parker makes their own glasses, they also have a much better control of the price, compared to the expensive designer options available at their competitors. Most of these companies have introduced online buying options, as well as a similar “virtual” home try on experience to Warby Parker's. There is still a lot left to see from Warby Parker, but they haven't stopped changing their industry yet.

Direct-To-Consumer companies aren't exactly new. Warby Parker has been around since 2010, Bonobos since 2007, and Casper since 2014. Of course, there are others that are barely hitting their 5-year mark or less, such as Quip. Quip is a trendy new type of electric toothbrush and other oral-care products, as well as an associated app. They don't currently have a showroom or any dedicated real estate, but they do take up a significant amount of space in the aisles of Target, Walmart, and Bed Bath and Beyond. These very specific, but very well-loved DTC companies are starting to take up shelf space in mainstream stores, which draws people in. Other companies like Bombas, Pura Vida, and Reformation can also be seen in mainstream department stores like Nordstorm and Bloomingdales. As the saying goes… meet people where they are.

While we don't currently track any DTC companies in REGIS Online, it's only a matter of time before someone asks. As companies like Casper and Purple expand their showrooms and retail strategy. It's important to know what's going on in the market. Using REGIS Online, we mapped out the 12 Casper showrooms and 9 Purple showrooms in California to see any patterns in their strategy. Both companies seem to like being in the same markets - specifically in the same shopping center. Casper and Purple both have showrooms in shopping centers in Torrance, La Jolla, Brea, and Racho Cucamonga. While they're still growing, this strategy makes sense. But, it's only a matter of time until Casper, Purple, Tuft&Needle, and the many other companies start taking over those established retail spots.

It almost seems like the opposite of what we've talked about on this blog before. Every financial expert and analyst likes to claim that commercial real estate is a dying industry due to online retailers and modern shopping habits. While there are certainly parts of this industry that are changing (or need to!) one thing is clear: The biggest, newest, and most innovative companies are beginning to recognize the power of real estate in their expansion plans. Now, it's time for commercial real estate see it too. •

Last Modified Aug 26, 2022